ALIGNED INCENTIVES

OUR GOAL IS THE SAME AS THE HOMEOWNER

BUY LOW / SELL HIGH

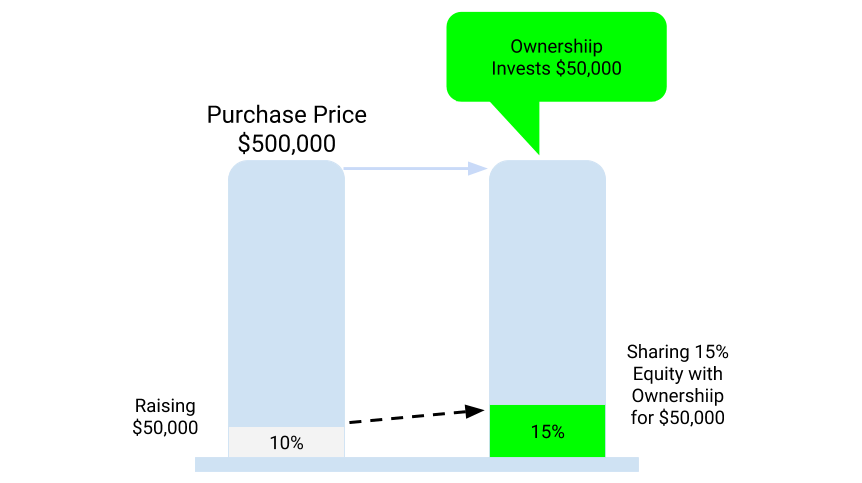

Let’s look at an EXAMPLE here. If you need $50,000 towards the purchase of a $500K property, depending on your market and the property, we may take 10%-25% equity in your property. Assume that we receive 15% equity for our investment in your property.

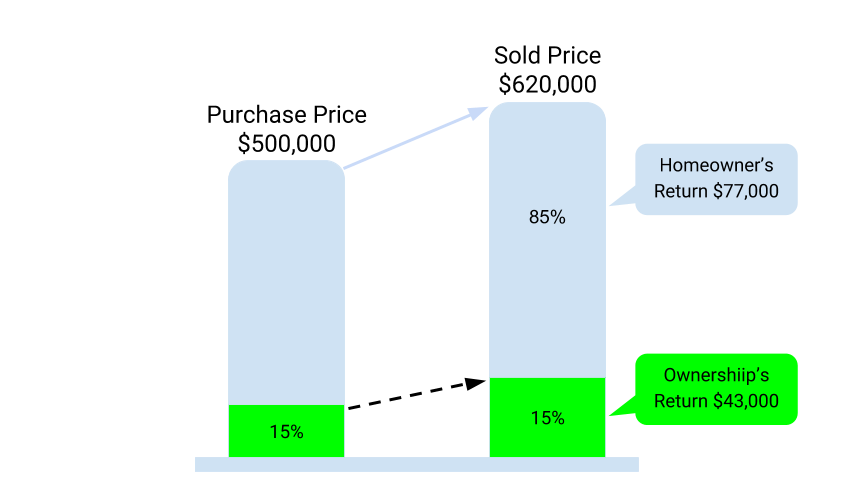

When you sell the property at a higher price, we will both win and have a positive return. Let’s say the property is sold at $620,000. The homeowner, who now has 85% of the property, would have a positive return of $77,000 ($620,000 x 0.85 – $450,000) and Ownershiip’s return would be $43,000 ($620,000 x 0.15 – $50,000). If the property is sold at a lower price or if the bank forecloses the property, we both could lose money and have a negative return.

SIMPLE INVESTMENT TERMS

JUST GOOD BUSINESS / GOOD PARTNERSHIP

3-5 Years Investment PeriodWe typically stay with our investments from 3 to 5 years. Anytime during this period, you may decide to sell the property or buy back Ownershiip shares without any penalty or additional fees. After this period, you will have to buy back Ownershiip shares |

|

No Monthly PaymentsThere are no monthly payments or interests charged on the Ownershiip investment during the Investment Period. We calculate our risk when we purchase shares in the property |

|

Entry Home PriceEntry or initial home price is the same as the buyer’s purchase price Exit Home PriceExit or final home price is the higher of the sale price or the appraised value at the end of the investment period |

|

Homebuyer Has Full ControlYou are in full control of the property and will decide as when to sell or what repairs to make. Ownershiip is NOT added to the title of the property, rather our investment stays as a lien on the property |

|

Ownershiip ExitThe Ownershiip investment may come to an end when:

|